Big news for tenants & landlords wanting to sell their tenanted properties!

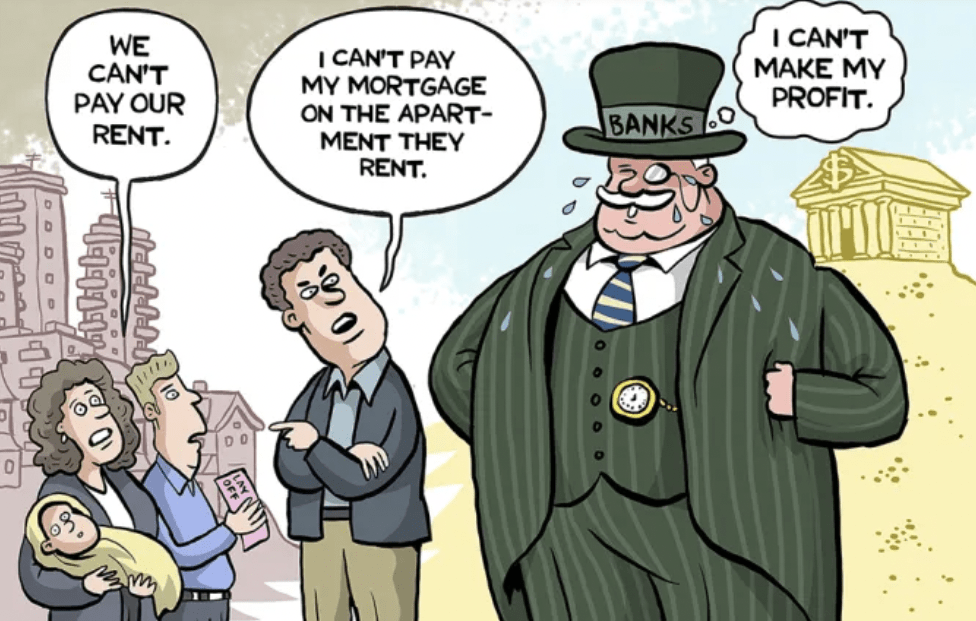

🔥 Hot off the Press! Big news for tenants & landlords wanting to sell their tenanted properties! The provincial government is introducing what they are calling “tenant protections.” But it really looks like they are trying to penalize landlords. Requiring landlords to give 4 months notice will make their properties undesirable and hard to sell, because of the long closing period. Sellers will need to contact the listing agent in July if they want the sale proceeds by January (if the requirement requires 4 full months to vacate upon sale). And buyers would be hurt by the unintended consequences, as their mortgage rate-holds expire after 4 months. Having to get a second mortgage rate-hold means buyers could face unexpected, higher monthly payments at closing. And this means that first time buyers might need to become landlords for short periods of time before moving in themselves. Acting as a landlord for two months may cost buyers a few thousand dollars more, if they’re subsiding the unit before moving in. Another loser from today’s announcement is the BC taxpayer. Presumably, the government will need to staff a new bureaucracy to oversee and enforce their new website. (Hopefully, it’s nothing like the Arrive-Can app which cost Canadian taxpayers $27 million). Don’t get me wrong— I’m all for reasonable tenant protections. I was once evicted by a landlord using the “fixed-term” trick on me. When I first moved to BC more than a decade ago, a Building Manager offered me a fixed-term lease, and promised to renew it the following year—only to renege and force me out. 🥲 Annoyed at first, I didn’t dwell on it. I moved on, and things worked out for the best. The current notice period of 90 days is sufficient for a tenant to find new accommodations. I rented 12 (give or take) apartments/accommodations before I bought (including Japan, Australia, and Mexico), and I don’t believe it ever took more than 2 to 3 weeks to find one. In a nutshell, I believe the new changes are unnecessary, as they add a layer of bureaucratize, making things more complicated. (Not to mention the hidden costs to all of us) If you’re curious to learn more about how the new “protections” could apply to you, check out our quick notes below. Quick notes: – Starting July 18, 2024, landlords will be required to use the Landlord Use Web Portal when they are issuing Notices to End Tenancy for personal or caretaker use, with a unique notice ID when ending a tenancy. – Landlords will need to give 4 months notice instead of 2 months. – The person moving into the home must occupy it for a minimum of 12 months and landlords who evict in bad faith could be ordered to pay the displaced tenant 12 months’ rent. – Tenants will have 30 days to dispute Notices to End Tenancy instead of the current 15 days.

Spring Market Update 2024: The Temperature of Vancouver’s Housing Market

I’m surprised by the lack of activity we saw in sales and listings this March 2024. Right now, the market feels “mild” to me — not hot but not cold. The numbers from the Greater Vancouver Realtor’s news release show sales 30% below the 10 year average. Too many buyers are sitting on the fence hoping rates fall. Best time to buy is when everyone’s running the other way. Some good deals out there now in Air-conditioned buildings in Downtown Vancouver–some two bedrooms are selling $100K cheaper than several years ago! On interest rates, I don’t expect rates to rise much from here, and I don’t believe they’ll fall either (because inflation in Canada and US is stubbornly high between 3 and 4%). Take the Bank of Canada at their word when they say rates aren’t coming down until they wrestle inflation down to 2%. Which is the better mortgage product: Variable or Fixed? I wouldn’t choose the variable rate today. I’d choose a 3 year fixed, because rates won’t come down by much (if at all) in the next 18 months. Some brokers are getting 4.9s or 5% fixed rates which is better than the 6.5% variable. Even if the Variable came down 150 basis points (1.5%) over 18 months, you’d save way more money on the fixed. Inventory remains low. While higher than this time last year, we’re still 9.5% below the 10 year average for listings. We may see an increase in condo listings across Greater Vancouver, because anti-AirBnb legislation handcuffs owners’ use of property. Rental rates are too low to make positive cash flow off long-term rentals (Yes, even with today’s rental rates!). How many owners will cash out? My guess is that Downtown Vancouver condo prices hold steady and possibly trend a few percentage points lower. I wouldn’t wait to pull the trigger, because lower rates won’t be with us until 2025 at the earliest. Nothing points to a large number of detached listings coming to market. There’s few newly built/renovated homes. Expect this trend to continue. Here’s a link to 79 detached homes that sold on the West Side between March 1 and today: Click Here to View Listings I picked the following four homes that are renovated/newer-ish and with suites/basement income in Kitsilano, Point Grey, and Arbutus, because buyers need the income to help shoulder monthly payments. If you had to choose, which 3 or 4 would you buy from this list? Click Here to View Listings Okay, so I picked out these 4: 3180 W 3RD AVENUE: $3.37m – renovated 1920s house. 3828 W 15TH: $3.57m 3765 W16TH: $3.5m 2885 W 20TH: $3.3m Don’t get anchored to assessment values! Some buyers give very little thought to it. Look more at the property’s desirability (lovely yard, deck for summer bbqs, quiet tree-lined street, etc.) and focus on market values (final selling prices). The four homes above sold between $75K to $400K above their BC assessment values ($75K, $189K, 294K, and $371K over assessed). As for West Side house prices, I don’t think they have much further to go down. The big shock to the housing market was the drastic increase in rates through 2022 and early 2023. A rapid rise in rates like we saw is the biggest hammer to the housing market. Detached homes on the West Side weathered the storm and modestly ticked up, with prices 4% higher on the West Side year over year. Watch for prices to pick up from here. Over and out. Christian Butzek 778 322 6745 5-Star Rated Realtor. Google me! Top 10% of Realtors in Greater Vancouver in 2017-2019, 2022-2023

Waterfront living at a Fraction of the Cost?

This was a first for me! My clients and I viewed a float home for sale in the Queensgate Marina in New West. I’ll share my viewing notes with you in this post in case you’re curious about float homes. You literally live on the waterfront in a quiet, secluded community at a fraction of the price. Whereas it would cost you millions for a house near Vancouver’s waterfront — think Point Grey or Kitsilano ($4 to $5 million minimum in 2023), you can score a New West float home for under $1 million. For starters, they’re a rare find; there’s only around 800 float homes in southern BC. The Queensgate Marina has just 15. Some like Coal Harbour have just 3 spaces for float homes, so years can go by before you see one up for sale. You still pay property tax to your local municipality like you would with a home on land. Services like water and gas are connected to the float homes, though Queensgate is one of the only marinas to have a gas line, which is advantageous for heating and cooking. And make your energy bills cheaper! Your home will rise with the high tide in the spring thaw when the snow melts in the mountains and runs off. The tide in the Fraser River can rise to 14ft. The changing tide can make it harder for older or fragile folks to walk up to the ramp where from home to land. Float homes come with water lots. This marks that little piece of body of water which belongs to you. For the home we saw, it was 142sq m. The house is considered a “chattel,” a term we use in real estate to refer to a moveable item. Property Transfer Tax only applies just on the water lot and not on the house. So if the water lot is valued at $400,000, the PTT equals $6K for the purchase. Float homes are custom built. Because it’s such a niche market, there’s few builders to approach. My understanding is that there’s only two in the lower mainland. The first is IMF which builds float homes in Seattle, Portland, and Vancouver. The other is a local builder called Lansen Homes. The listing agent shared that Lansen will only build float homes that are a minimum of 1500sq. ft. If I understood her correctly, the cost of a home today can run up to $650,000. Though, I imagine it could cost more if you’re building a larger home. Float homes are a great lifestyle choice if you want that quiet, secluded feel and you love being on the water. You’ll have a boat slip beside your home to park your boat. You also have a car parking space outside the marina reserved for your use. Because Queensgate is far from shopping, you’ll need to do a lot of big box store shopping runs to load up on groceries. When it comes to financing, options are limited. I understand that there’s only two lenders that will offer loans, TD Bank and Envision Financing. With just two lenders, you’ll have a harder time negotiating a better rate. Insurance will be higher than your average condo or townhouse, since your entire home could be at risk. We were told that rates are $2500 to $3000 per year, though insurance rates are always changing, so the numbers I share here could be out-of-date by the time you read this. If you want more information, you can find it by checking out the Floating Home Association of BC. Here’s a link to their Did you know? tab: https://www.floatinghomesbc.ca/did-you-know Thanks for reading. Best.

Are Low Interest Rates Gone Forever?

You want to bet interest rates are coming down in the next 2 years? I don’t. Because it’s my view that interest rates are now returning to normal levels. Remember the 1970s? 80s? 90s? Or even the early 2000s? When I was a teenager in the mid ’90s, I remember my parents complaining about their mortgage payments but not their mortgage rate, which was around 7%, normal at the time. Going back further, interest rates in the 1970s bounced around the double digits. 1980s rates often ranged between 8 to 10% range. Even the early 2000s saw rates between 5 and 6%. If you ask me, today’s buyers have a serious case of recency bias when it comes to interest rates. They think rates will come down because that’s what they’ve been used to for the last 10 years. Recency bias is a psychological tendency we all fall victim to. We make decisions about the future based on the most recent information and events, because that’s what’s fresh in our minds. And when it comes to mortgage rates, so many buyers wistfully dream of a return to 2 to 3% interest rates of the 20-teens. (I had one client score a 1.69% interest rate in June 2020 during the pandemic.) But it would be a mistake to wait or hope for rates to come down. It would be worse to base your decision to buy on rates coming down. The golden era of low interest rates is over. I’ll prove it to you. Look at historical rates dating back half a century to draw comparisons with today: Source: https://www.toonpool.com/cartoons/Interest%20rate%20raise_120111 One look at this graph shows rates are just now returning to pre-2010 levels. The collapse of financial markets in the fall of 2008 ushered in a period of unprecedented low interest rates. You can run your finger all the way to the left–1975–and you’ll see nothing but rising rates. Some buyers visiting my open houses tell me that they’re in a holding pattern, hoping that rates will come down. This reminds me of the filmmaker James Cameron’s line: “Hope is not a strategy.” Reading between the lines, what some people are saying is that they can’t afford today’s payments. Understood. But for buyers waiting to pull the trigger on a home purchase in the hopes rates come down, I got news for you: Interest rates aren’t coming down anytime soon, and there’s a simple reason why. The Bank of Canada has a mandate to wrestle inflation down to 2% levels. But the latest CPI numbers are expected to come in at close to 4%, which is still way too high, for the BOC to consider lowering rates. Inflation may be far more entrenched than we thought 16 months ago. It could take years before inflation returns to a steady 2%. Get used to it, friends. Today’s rates are the new normal.

Will a Tsunami of housing demand drive BC one-bedroom rents to $4500/month?

Folks, what’s the future of rental rates when you have 100,000 people moving to BC each year? For possible answers, let’s look to the recent past: Rental rates for one-bedrooms in Vancouver averaged $1900/month in February of 2017. Fast forward to today and the average for a one-bedroom just clipped $3,000/month. That’s a 63% increase in 6 years. Ouch! That said, you can get into an older purpose-built rental in the West End, for example, for much less than $3000/month. When I first came to Vancouver I sought out the older stock, because I liked the affordability (lower payments) and the security. You can’t get booted out by an unscrupulous landlord moving in his “mother” for a few months or doing a phantom renovation, like swapping in a new stove. If you believe Brendon Ogmundson, the Chief Economist at the REBGV, BC will be short a whopping 900,000 homes by 2030 if current growth trends continue. Let me paint the picture for you: A while back, I was walking down Burrard Street with my future wife. We past a group of two dozen people outside the Electra (the old BC Hydro building) at the corner of Burrard and Nelson. I thought they were celebrity hounds waiting for a movie star. When I approached one and asked what was up, she said that they were waiting to view the rental unit. That was 2015. I told my wife to expect rental rates to skyrocket when you have groups of 40 to 50 people viewing one rental unit in an old building like the Electra (with no parking available). Today, I see this pattern repeat itself with my investor-clients. I had one who listed his one-bedroom for rent near King George. No sooner did he have his ads up on Facebook Marketplace and Craigslist and his inbox was flooded with 40 inquiries in two days. CMHC (Canada Mortgage Housing Corporation), an arm of the federal government, suggests BC is short 610,000 homes. And with our population growing at 100,000 per year, the gap widens. The most new homes finished in a single year was 42,000 in 1993. BC averages 30,000 newly constructed per year. That’s still 70,000 too few to meet the needs of a growing population. Hence, you get a shortfall of 900,000 homes by 2030. So get ready for lineups outside rental listings! I’ve even had online leads call me asking for help. My advice for rental seekers is to dress like you’re going for a job interview, bring your references with you, and don’t negotiate with the landlord to reduce the rent if there’s a line up of people behind you. If we see a repeat of the last six years of increases, then one-bedrooms would reach nosebleed levels of $4500 per month by 2030. And if you don’t think that can happen, study other big markets like Manhattan where the one-bedroom rents average $4800/month CAD.

The Real Estate Crash that Never Comes

There’s so much misleading garbage written on the internet about Canada’s housing market…it leaves me shaking my head. I just read a piece by a well-known YouTuber that’s trending on LinkedIn about rising interest rates. Why do we see such negative news? Because it’s great bait! Bad news attracts an audience like nothing else. Like bees to honey. In order not to get sucked into the negative news vortex, you must ask some basic questions about the material you’re reading. So let’s put on our critical thinking hat for 2 minutes and dissect this YouTuber’s blog post. I’ll show you, line-by-line, what I’m thinking as I read through this gentleman’s post. And if you disagree with anything I write, say so. I can be wrong, but I don’t think I’m wrong about this. The well-known commentator starts, “There are growing concerns about the state of variable rate mortgage holders across the country. At this point, nearly everyone who’s on a variable rate mortgage has essentially hit their trigger rate. It’s become front page news, and rightfully so.” Okay. So what are the growing concerns? Are we concerned they’ll all default and thereby crash the market? And if that’s the case, why hasn’t the market already crashed since the Bank of Canada started raising rates in March of 2022? Couldn’t one reach the opposite conclusion? Isn’t it a sign of the underlying strength that the Vancouver and Toronto real estate markets are at all-time highs amid 10 rate hikes since March 2022? In fact, after home prices tailed off last fall, they rebounded in the spring of 2023 to near record highs amid interest rate hikes not seen in 40 years. Doesn’t that suggest that buyers are able to afford higher rates and home prices? The YouTuber continues, “Unfortunately this story isn’t going away anytime soon, as Tiff Macklem and his second at the BoC look poised to jack rates another 25bps this week. The market is placing nearly 60% odds of a rate hike, while 20 of 24 economists polled by Reuters expect a hike on July 12th. That would push the prime rate to a dizzying 7.2%.” Done. The BOC raised rates. By the way, why should we care what 20 out of 24 economists predicted? Since when are economists right? How many economists correctly predicted today’s interest rates two years ago? Remember how economists said inflation was supposedly “transitory” in early 2022? Then the language shifted from “transitory” to “entrenched” and rate hikes followed. The economists and experts were writing the script as they were going along. While we’re on predictions, remember how the CMHC (Canada Mortgage Housing Corporation) predicted in May 2020 that home prices could fall by 18%? Boy, was that way off the mark! We saw home prices rise 40% in some Canadian markets because of rock-bottom 2% interest rates. I had a client get a 1.69% rate in June of that year. It reminds me of Burton Malkiel’s theory that blindfolded, dart-throwing monkeys will outperform stock-picking experts on Wall Street. The truth is that economists, financial advisors, and not even Realtors like me can predict the gyrations of financial markets in the short run, and you’d be crazy to put much stock into their prognostications. Hence, you must ask critical questions about the news you’re reading. The YouTuber continues, “The feds knew this was going to be a problem. Remember the March 2023 budget?” Nope. I don’t remember the budget. What specifically are you referring to? He writes, “Right on cue. Here’s the official message from The Financial Consumer Agency of Canada (FCAC) this past week. Basically, The FCAC wants banks to work on amortization extensions, waive lump sum prepayment fees, waive prepayment fees on distressed sales, and waive interest on capitalized interest.” Finally, some meat on the bone… Waiving lump sum pre-payment fees, as they do in the US, seems like a no-brainer. Why can’t we do that here in Canada? Extending amortizations is already the case in many countries. Finland has 60-year amortizations, and Switzerland and Japan have 100 years of amortizations (intergenerational mortgages). Didn’t Canada have 35 amortizations? Why did we get rid of those? The YouTube continues, “Remember, 56% of all new mortgage originations in January 2022 were variable rate. Ouch.” Ouch indeed if you’re on Scotiabank’s variable with no fixed payment! How many of that 56% were with Scotiabank? Canada’s other 4 big banks all have fixed payments, so some variable rate holders may just now be hitting their trigger rates. And what then? Throw the keys on the table? No! You have options. You could increase your monthly payments. You could pay down some principal owing on the mortgage. Here’s the bait. It’s the line that gets you biting your fingernails and fearing that the housing market will crash: “Remember, 56% of all new mortgage originations in January 2022 were variable rate.” Hey, what about the stress test? How come no one mentions that anymore? Wasn’t that meant to add a built-in buffer for mortgage holders so that they could support payments if rates went higher? By extension, wasn’t that buffer supposed to help protect the Canadian housing market from exactly this type of situation? The stress test required buyers to show they could support payments on rates 2% higher than their qualifying rate. In other words, if you were qualifying at 3.8%, you needed to show that you could support payments if rates rose to 5.8%. Granted, variable rates are now higher, but homeowners like you and me also had the option of breaking their mortgage, paying the penalty, and rolling into a lower 3 or 4-year fixed. How many people did that? I did. I bit the financial bullet. Ask me how if you’re curious. Anyway, he continues, “Basically Tiff Macklem needs to tank the economy, and quickly, in order to bring interest rates back down to more manageable levels. Unfortunately, we’re waiting for those signals to show up in lagging data.” No, he doesn’t

Prime Minister Trudeau to rescue Canadians from high house prices?

Dear readers, After Canada’s real estate market skyrocketed by 40% in the pandemic era, provincial governments rode to the populist rescue with anti-foreigner taxes and new bans. It’s dubious that these policies will have any impact. After Canada’s real estate market skyrocketed by 40% in the pandemic era, provincial governments rode to the populist rescue with anti-foreigner taxes and new bans. It’s dubious that these policies will have any impact. The Federal Government banned foreign buyers from buying real estate in Canada for two years starting on January 1st, 2023. How many foreign buyers are out there? The numbers for Vancouver show that only 10 of every 1000 buyers is a “foreign buyer.” Removing 10 buyers out of 1000 will not make a difference to affordability. It’s a drop in the bucket! This ban is somewhat dishonest if it isn’t meant to address housing affordability directly. Maybe this policy is meant to win the governing Liberals votes by currying favour with a majority of the public. Opinion polls suggest a majority of Canadians support new taxes and further restrictions on non-Canadians who own real estate. How many homeowners leave their homes empty? The BC Government revealed that only 2900 condos had been declared vacant based on the date they collected where the tax is applied. 2900 new residences is a good start but fall far short of addressing availability when 103,000 newcomers moved to BC in 2021. The penalties for leaving your home empty will hit the pocketbook hard which will dissuade foreign owners: In Vancouver alone, the City Council increased the Empty Homes Tax (EHT) to a whopping 5% of the assessed value for 2023! And we haven’t even factored in BC’s (the province’s version of the tax). This means owners of a $1 million dollar assessed home would have to pay a $50,000 penalty for leaving it vacant. But does that make homes more affordable for you and me? Fines for foreign owners sound like a great policy, but it won’t address the core issues of the availability of hundreds of thousands of homes which are desperately needed with the influx of immigration. Ottawa’s target is to welcome 1.5 million new Canadians over the next three years. Furthermore, we’ve seen prices come down with rising interest rates. The federal government has arrived late to the game and is going after foreign buyers, because it sounds great and wins support. It won’t make homes more affordable for you and me.

Severe worker shortage driving inflation?

Dear Readers, Is the Bank of Canada driving down the wrong side of the road? And are you and I going to be the collateral damage in this fight to bring down inflation? If you’ve figured this all out, please help me understand how raising interest rates is supposed to help dampen wage growth when there’s a massive shortage of workers. On the news broadcasts, the talking heads tell us that wage growth in the services sector is driving inflation. The most recent numbers say that there are almost 1,000,000 job openings across Canada–the highest I’ve seen in my lifetime. Wage growth grew by 7.5% year over year to $24.50 per hour. The latest numbers say that there’s 81,000 vacancies for construction workers. 63,000 openings for scientific and technical services. Human nature being what it is workers will keep leaving one job for another if they can make more money. Wouldn’t you? In theory, the Bank of Canada (BOC) could crank up interest rates to 6% or 7% (or more?) and still not slow wage growth because there’s simply not enough workers to fill all positions. If a severe shortage of workers is a large contributor to the underlying cause of inflation, more interest rate hikes may not have the desired effect. Workers can always shop around for more pay. I had a software engineer client of mine tell me that high demand for high-skilled people in his sector was driving salaries up from $300K to $400K per year. In the end, the BOC’s decision to increase rates leaves a wake of collateral damage. Individuals and couples not on fixed payments are seeing their mortgage servicing costs rise by $300 a month and $3000 in some instances. If there’s an underlying structural issue that needs major fixing–like we need more workers and fast–why not make that the focus? I get that the Government of Canada has announced a plan to bring in 1.5 million new immigrants in the next 3 years. 450,000 are supposed to make Canada home in 2023 alone. But if the BOC’s goal is to control inflation through rate hikes alone, they’ll need to drive demand through the floor with interest hikes resembling the early 80s. Do we want to live through the economic mess that comes after? Do we want our kids to live through a stagnant decade with fewer job prospects? Readers, you may have more insight into this than I do. So I’d love for you to help me understand how rate hikes will bring inflation back to 2% when we’re one million workers short in this country.

BC removes rental restrictions: Who are the Winners & Losers of this Change?

Good news for owners and tenants! … Bad news for 1st-time buyers and low-budget buyers! One of the biggest roadblocks to selling your unit in BC has always been rental restrictions, since it requires the buyer to be an end-user. This will change when this policy becomes law!!! Owners who own a condo with rental restrictions will no longer be forced to sell when they move. They can keep their unit and now rent it. Second, owners will see their home values increase by tens of thousands of dollars because they can sell to anybody—not just end-users. For example, a $600K unit will see a bump of about $20K to $30K once restrictions are lifted, because there’s more buyers for the unit, which makes the unit more valuable and pushes up prices. The benefit to tenants is obvious. There’ll be more rental options in some of Vancouver’s oldest but most desirable neighbourhoods like Kitsilano and West End, where it seems that half of buildings have some form of rental restrictions. There’s no telling how many units this will add to the rental pool, but my guess is that it’s in the hundreds for Downtown Vancouver and areas like Kitsilano and West End. In many strata s, I find rental waiting lists that are years long with 10 or 15 owners wishing to rent their home only to be thwarted by a set of bylaws that handcuff their options. Again, the restrictions will disappear later this week when the legislation is passed. Make no mistake! Don’t expect this to lower rents. The big bonus is that it provides more options to tenants who want to enjoy the Downtown lifestyle and live within walking distance of work. However, this comes as a body blow to 1st-time home buyers. They’ll now have to compete with all other buyers, including deep-pocketed investors for the same condos. Prior to this change, stratas with rental restrictions were great options for 1st-time home buyers. There was less competition for these units because investors avoided them. In a nutshell, this will increase rental supply and give more options to homeowners. What is your opinion on this? Happy to see restrictions lifted? Call or write me if you want help understanding the impact this has on you and your family! CHRISTIAN BUTZEK OAKWYN REALTY DOWNTOWN c: 778 322 6745 e: me@vancityhomelistings.ca

Why do some people cheer for a real estate crash?

Recently, I had dinner with a friend who rents. She said she’s cheering for the real estate market to crash, and threw her arms up with glee at the current downturn in prices. Why I ask? Does my friend fully understand what she’s wishing for? Cheering for a real estate crash isn’t like rooting for the New York Yankees to lose or for an icon like Christiano Ronaldo to miss his shot on goal. It’s wishing ill on others. Would you cheer for your neighbour to lose their job? Or for your brother-in-law to go bankrupt? Imagine the ripple effects in BC’s lumber industry when housing starts slow down? A crash in values will slow construction and cause thousands to lose their jobs. Many people have the perception of homeowners as rich. This is wrong. Canadians who own homes are just like you and me. Even where homes are valued over $1 million, many families will rent rooms in their basement to help shoulder the mortgage. An extra $700 a month for a room is a big deal to a middle-class family struggling to pay their mortgage, especially those who are seeing an increase in their monthly payments. In many instances, couples have worked years to save up their down payment for a shot at a single-family home. And many of my clients ask parents for help with the down payment. Some renters will tell you that they’re cheering for a crash in home values, because prices are too high. What do they care if they have no plans to buy? Most don’t, just like my friend. Couples who’ve made the decision to own their own home often value personal freedom and the financial independence that comes with long-term home ownership. Vancouver homes that sold for $300,000s in the 1990s sell for five times as much today. And with it comes the financial security we should all wish for each other. In many instances, couples make great sacrifices to claw their way into the real estate market by limiting purchases of a family car or even delaying children The truth is that people buying homes today have strong reasons and the steely determination to turn their home aspirations into reality. I feel that the real reason why people cheer for a housing collapse is that they envy homeowners. They envy the very thing they don’t have.